Opening of Bank Account in Singapore: Key Factors for Bank Review and Account Opening Process

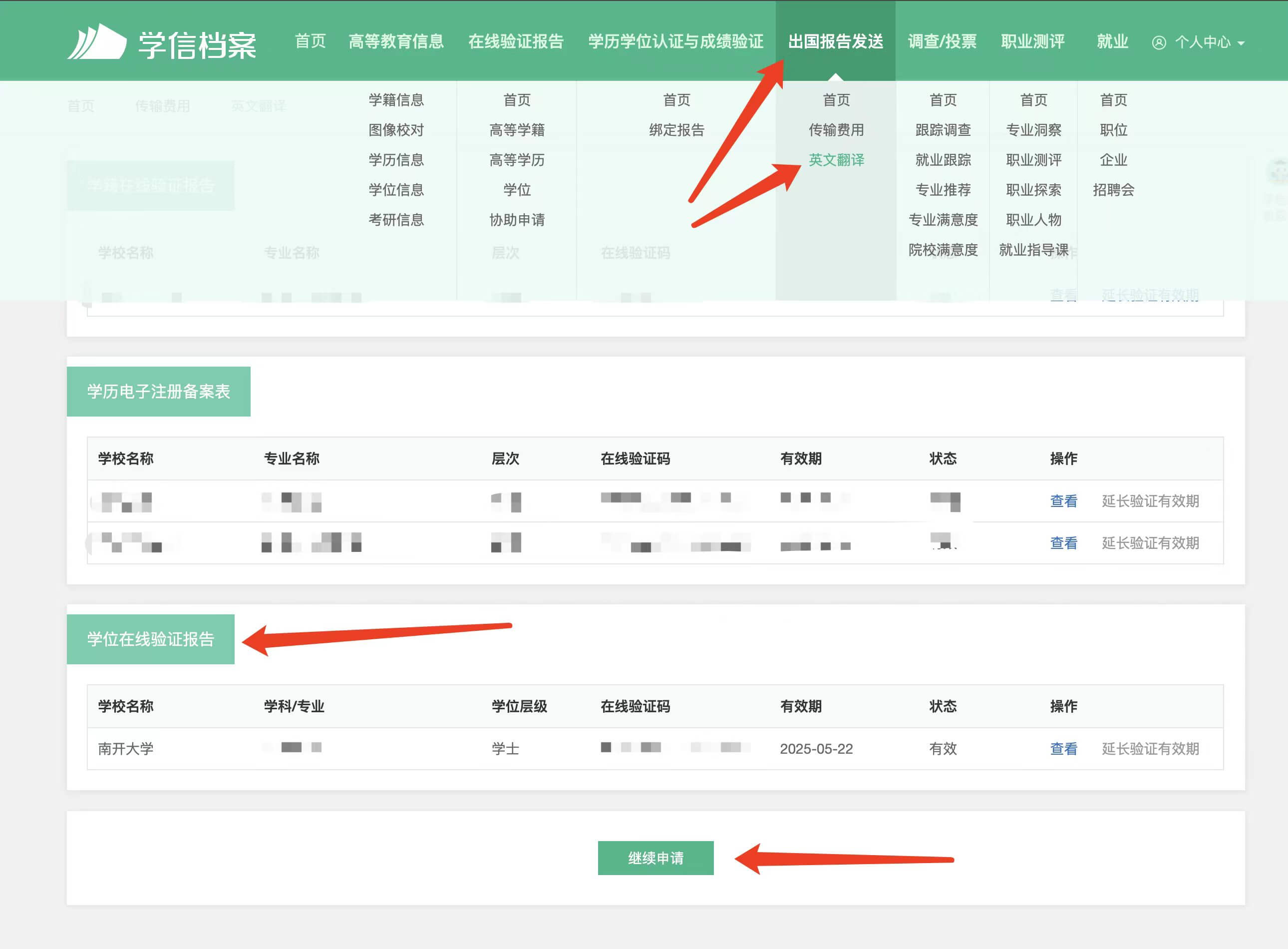

This article introduces the account opening process and required documents for physical banks (DBS, OCBC, UOB). If startup companies believe their conditions do not meet the requirements of physical banks, they can consider opening a digital bank account(Aspire) first and apply for a physical bank when conditions mature.

Required Documents for Account Opening

1. Business Details of the Company Opening the Account: Provide a detailed introduction to the company's business, including business model, main customer base, and supply chain, ensuring the bank understands the business content and operational background.

2. Reasons for Establishing the Company in Singapore: Explain why the company chose to establish in Singapore, such as expanding into the Southeast Asian market or enjoying Singapore's financial advantages, demonstrating the rationality of setting up a Singapore company.

3. Initial Fund Deposit Plan: Confirm whether the initial funds can be deposited within two weeks after the account is successfully opened, explain the expected amount and source of the initial funds to help the bank understand the legality of funds and initial liquidity.

4. Fund Flow Plan After Account Activation: Confirm the incoming and outgoing transactions after account activation, including expected amounts and monthly transaction frequency, helping the bank assess the account's fund flow and usage frequency.

5. Related Company Information: Provide information on all related companies (such as companies currently or previously owned by directors in China), including business licenses and bank statements for the past three months, to help the bank assess the related company network and compliance of fund flows.

6. Transaction Proof from Suppliers and Customers:

Provide the full company names, registration countries, and related transaction proof documents for 2-3 suppliers of the Singapore company or Chinese related companies.

Provide the full company names, registration countries, and related transaction proof documents for 2-3 customers of the Singapore company or Chinese related companies. The bank will use this information to confirm the authenticity of the company's upstream and downstream partners.

7. Transaction Intentions and Proof in Southeast Asian Markets: Confirm whether the company has intended transaction counterparties in the Southeast Asian region, including customers and suppliers. If yes, please provide at least 2 business transaction proof documents to support the company's actual expansion intentions in Southeast Asian markets.

8. Personal Resumes and Work Experience Background Summary of Shareholders and Directors: Provide personal resumes or work experience background summaries for all shareholders and directors, allowing the bank to understand the management's industry experience and contribution to company operations, helping the bank assess the company's stability.

9. Singapore Work Pass Approval Notice (if applicable): If the employment pass for key personnel is under application, please present the pass approval notice issued by Singapore Immigration or Ministry of Manpower to prove that key personnel have the legal qualifications to work in Singapore.

The above information is not mandatory. If not available, be truthful and avoid fabricating or providing false information.

Additionally, avoid making unverifiable claims of relationships. For example, if claiming cooperation with a well-known company after opening an account, the bank will require relevant proof documents, even email exchanges can serve as evidence of business communication. However, if it's merely a verbal promise without substantial proof, it may be viewed as misleading or even deceiving the bank, affecting the account opening review.

Furthermore, any documents you promise to provide must be provided, even if you've moved to the next review stage. Documents promised in the previous stage still need to be submitted, so don't make promises lightly.

Additionally, whether the company has an official website is very important.

Account Opening Timeline

Singapore banks are not highly efficient, and account opening typically takes 4-6 weeks.

Bank staff usually respond to emails about once a week, and account opening typically requires three to four communications. After four emails, that's four weeks.

Email communications are usually about the documents provided. If documents are complete, there's no need for back-and-forth communication. After the bank collects all documents, the bank's internal review of account opening materials takes two to three weeks, so the entire account opening process typically takes about 4-6 weeks.

Banks support remote video account opening and can handle account opening matters from any country in the world.

Key Elements of Account Opening Document Review

I. Business Background and Establishment Motivation: Why Do Banks Need to Understand These?

Banks will require the company opening an account to provide detailed business information, including business model, customer base, and supply chain information. This not only helps the bank understand the company's revenue sources and fund flows but also allows the bank to better assess the company's operational stability and development potential. At the same time, banks will require companies to provide explanations for choosing to establish the company in Singapore. Explain why the company chose to set up an account in Singapore, whether it's related to expanding into the Southeast Asian market or enjoying Singapore's financial advantages. This way, the bank can better understand that the company's establishment and operation in Singapore is based on actual needs rather than existing as a shell or offshore company.

II. Relationship Between Work Pass and Account Opening Approval

For companies established in Singapore, if the work pass is under application, the bank will require an approval notice issued by Singapore Immigration or Ministry of Manpower to confirm that management or key personnel have legal work qualifications. Especially for foreign-invested companies or companies not registered locally, banks will pay more attention to the legal work passes of company management personnel to ensure that the company's presence in Singapore is reasonable and compliant with regulations. Therefore, having a work pass makes account opening easier.

If your documents fail to open an account successfully, you can also try applying for an employment pass first. Obtaining a pass means getting recognition from the Singapore government, making bank account opening easier.

III. Initial Fund Arrangement: Initial Funds and Liquidity Plan

When reviewing accounts, banks typically pay special attention to the initial fund deposit plan. After opening an account, banks generally require companies to complete the initial fund deposit within two weeks. Companies need to confirm the source, expected amount, and deposit time of these funds to the bank. This step helps the bank determine whether the company's working capital source is clear and legal, and the initial fund deposit is an important part of the bank's preliminary assessment of account liquidity.

At the same time, banks will inquire about the estimated transaction amounts and frequency after account activation, such as how many transactions are expected per month and the approximate amount of each transaction. These data not only help the bank better understand the company's fund flows and business scale but are also important bases for identifying abnormal fund flows in subsequent transactions. If the account's transaction situation differs significantly from the initial data, the bank may conduct further reviews to ensure the legality and security of the account's fund sources.

IV. Related Companies and Fund Flows: Why Do Banks Need to Understand the Company's Background Network?

When opening an account at a Singapore bank, information about the company's related companies is one of the key review points, especially the situation of companies that directors and shareholders have in other countries. Banks typically require business licenses and the past three months' fund flow statements for all related companies. This information helps banks understand the company's global operational network, ensure that the company's business activities in other countries are legal and compliant, and also eliminate the risk of transferring funds through multiple related companies. If the company's related companies can provide clear business transactions and fund records, it will help the bank confirm the fund sources and business authenticity of the account-opening company.

V. Supplier and Customer Information: Proof of Genuine Business Activities

During the review, banks will specifically require companies to provide transaction proof from suppliers and customers, generally requiring information on 2-3 suppliers and customers from Singapore or Chinese related companies, including company names, registration countries, and related transaction proof. These materials are key for banks to verify whether the company is genuinely operating. Especially for companies opening accounts in Singapore for the first time, transaction vouchers from suppliers and customers are the most direct proof of business operations, helping to enhance the bank's trust in the company.

VI. Regional Expansion Intentions: Need for Southeast Asian Business Proof

Banks typically review whether companies have expansion needs in Southeast Asian markets, especially cooperative relationships with potential customers or suppliers in Singapore, Malaysia, and other locations. For this reason, banks may require companies to provide intended transaction partners and business proof in Southeast Asian markets, such as concluded cooperation contracts or letters of intent. This review focus reflects the regional positioning of Singapore banking services. If companies can provide information and proof documents of Southeast Asian transaction partners, it will greatly increase the likelihood of passing the review.

VII. Shareholder and Director Background: Why Do Banks Care About Management Experience?

Finally, banks pay high attention to the background of shareholders and directors, typically requiring personal resumes or work experience summaries for all shareholders and directors. Banks will assess the company's management capabilities and business development potential by reviewing the management's past experience. If the management has industry experience or relevant market resources, the bank's trust in the company will also increase. Therefore, preparing the management team's industry background and success stories will help smoothly pass the review.

Summary

The account opening review for Singapore bank accounts covers various aspects including company background, fund plans, related company situations, upstream and downstream supply chains, and Southeast Asian market expansion intentions. Essentially, the bank wants to know who you are, what you do, what kind of money you receive, and whether the money carries risks. The core review element is to determine whether there is a money laundering risk.

Contact Us

Offices

60 Paya Lebar Road, #04-50, Paya Lebar Square, Singapore 409051

+65 80819877

starteamec