Annual Compliance Filings for Singapore Company

In Singapore, services such as corporate secretary, accounting, and work permit applications may be handled by different service providers based on individual needs and budgets, which is quite common. Therefore, secretarial firms may not always be aware of all the client's filing obligations, and if communication is not timely, they might assume that the client has already completed the filing, leading to missed deadlines.

For "annual filing" matters, due to different language contexts, there are various terms used online that actually refer to the same thing, such as annual review, annual return, annual inspection, tax filing, etc.

Let me now introduce you to the compliance filing requirements for small and medium-sized enterprises in Singapore.

ACRA (Accounting and Corporate Regulatory Authority) Filings

Financial Statements (FS)

- Financial statements include balance sheet, income statement, and cash flow statement.

- Financial statements for small and medium-sized companies do not require auditing.

- Financial statements are part of accounting services. If the secretarial firm does not provide accounting services, or if you prefer not to choose them due to pricing or other reasons, you can select another service provider.

Annual General Meeting (AGM)

- Held once a year (within 6 months after the end of the financial year) to review financial statements, discuss company matters, elect directors, etc.

- The first AGM must be held within 18 months of incorporation, and thereafter annually, with no more than 15 months between AGMs, and within 6 months after the financial year end.

Annual Return (AR)

- Filed once a year (within 7 months after the AGM), reporting the company's basic information and annual financial status.

- Singapore companies' "financial year-end date" is not necessarily the last day of the calendar year (December 31). For example, my company was incorporated on July 2, and I chose June 30 as the financial year-end date, so my financial year runs from July 1 to June 30, not following the calendar year.

IRAS (Inland Revenue Authority of Singapore) Filings

Corporate Income Tax (Form C-S/C)

- Filed once a year; financial statements for small and medium-sized enterprises do not require auditing.

- Financial statements cover the financial year period, not the calendar year.

- Form C-S applies to companies with annual revenue not exceeding SGD 5 million, earning only taxable income, and not required to submit detailed financial statements.

- Electronic filing deadline is November 30 each year (for the previous financial year).

Goods and Services Tax (GST F5)

- Companies that voluntarily register for GST or have annual taxable revenue exceeding SGD 1 million need to file.

- Filed quarterly, within 1 month after the end of each quarter.

Reporting Employee Income (Auto-Inclusion Scheme, AIS)

- Companies with 5 or more employees or those voluntarily joining AIS must file; other companies are not required to file.

- Filed once a year, must be completed by March 1 each year.

Withholding Tax (WHT)

- If the company makes payments to non-Singapore residents (such as consulting fees, management fees, royalties, interest), withholding tax must be filed and paid by the 15th of the month following the payment date.

Other Filing Matters

Skills Development Levy (SDL)

- Must be paid when hiring local employees (citizens, permanent residents, foreigners), including full-time, part-time, and temporary workers.

- The rate is 0.25% of employee salary, with a minimum payment of SGD 2 per employee per month and a maximum of SGD 11.25 per month.

- Paid monthly or on an irregular basis as chosen, either separately on GoBusiness or together with CPF contributions through CPF Board.

Central Provident Fund (CPF Contributions)

- Companies employing Singapore citizens or permanent residents must make monthly CPF contributions.

- Must be filed and paid by the 14th of each month.

Foreign Worker Levy (FWL)

- If employing foreign workers (SP or WP pass holders, excluding EP pass holders), monthly foreign worker levy must be paid.

- Paid by the 14th of each month through MOM (Ministry of Manpower).

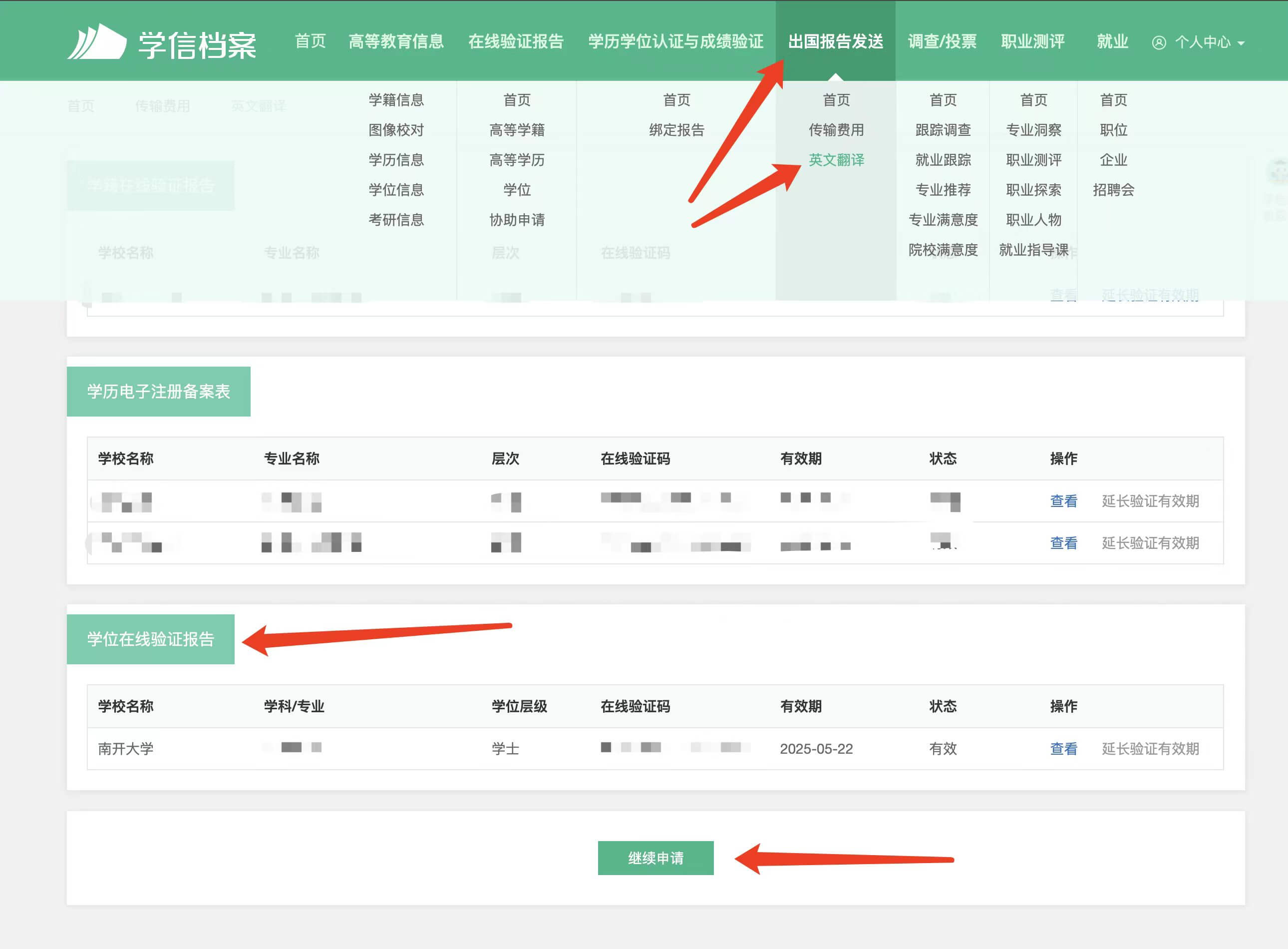

Service Allocation

All ACRA filing matters are the responsibility of secretarial services, with no additional service providers or fees required.

Employee income reporting, skills development levy, CPF, and foreign worker levy fall under Administrative services. Business owners typically handle these themselves, or can outsource to secretarial firms. Market rates are charged per person, ranging from SGD 100 to 200 per person per year.

Corporate income tax, GST, and withholding tax filings fall under Accounting & Tax services, also known as bookkeeping and tax filing services. Market quotations vary greatly, generally based on the number of transactions, with common quotes ranging from SGD 2,000 to 10,000 per year. However, Bookfo.com's combination of software and manual services can save two to three times the cost.

Contact Us

Offices

60 Paya Lebar Road, #04-50, Paya Lebar Square, Singapore 409051

+65 80819877

starteamec